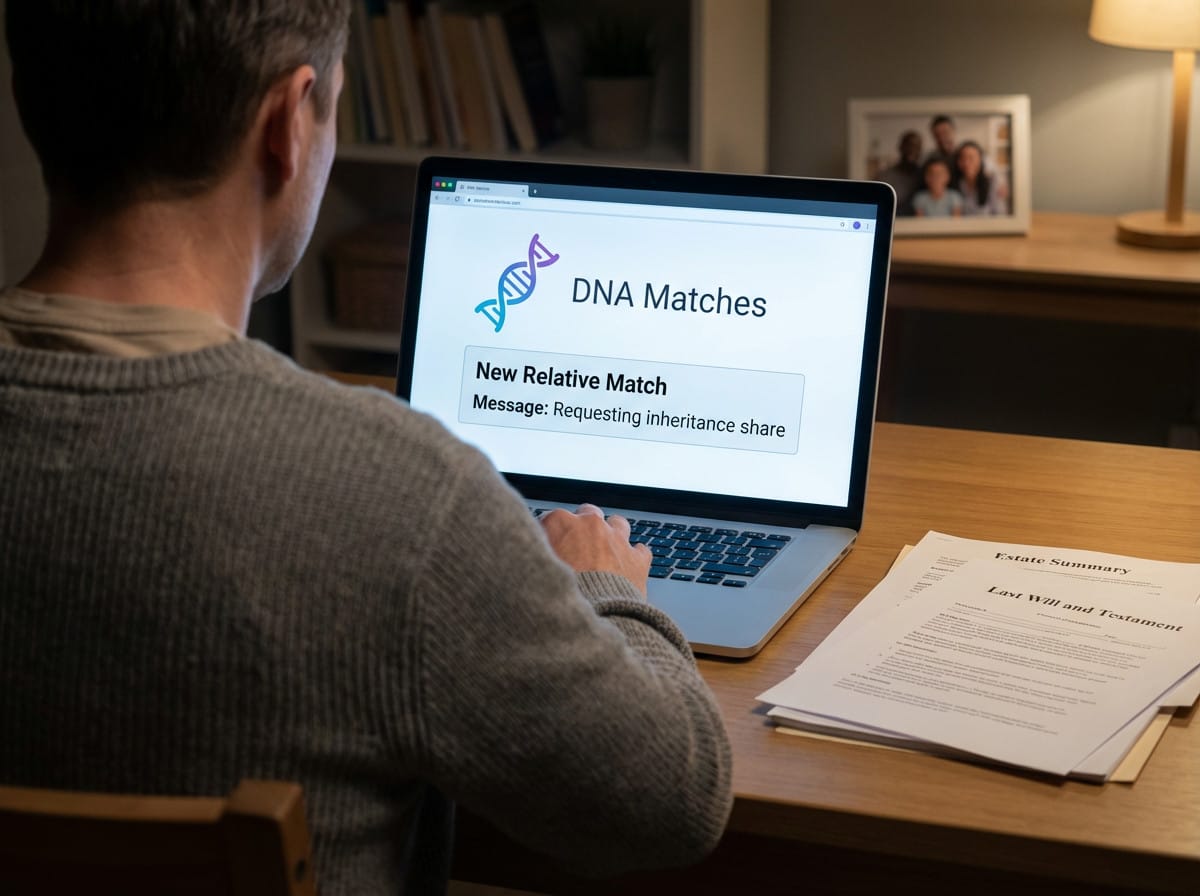

They Found a Match on 23andMe and Wanted Money

December 16, 2025

The growing popularity of at-home genetic testing kits, often taken out of simple curiosity to learn about ancestry or health risks, is inadvertently creating complex challenges for families and their financial legacies.

How to Put Together Your Legacy Drawer

December 19, 2023

If your family loves you unconditionally now – and they probably do – there’s an easy way to keep that love alive after you’re gone.

Should Children Inherit Equal Wealth?

August 15, 2023

Dividing up your estate among offspring can be a tricky business.

Losing an Inheritance Is Easy, Because Saying No Is Hard

March 16, 2021

Many beneficiaries view their inheritances as free money, experts say and some run through their sudden wealth on cars, major house renovations, and large gifts to children.

Beware, the IRS is Eyeing Your Inherited Money

September 17, 2019

One of the perils of being well-off is the constant risk that the federal government and/or your friendly state and local tax collectors will figure out new and different ways to snatch more of your wealth, especially wealth that you earned the old-fashioned way: by inheriting it.

Beginner Estate Planning

November 20, 2018

For millennials, it's never too early for estate planning.

Letter Of Intent Will

September 18, 2018

While it has no legal standing, and a letter of intent cannot override a will, it can be an invaluable document for your family in any kind of an emergency, not just your passing.

Supreme Court Decides That Inherited IRAs Are NOT Retirement Accounts

June 24, 2014

On June 18th, 2014 the U.S. Supreme Court decided that, for the purpose of federal bankruptcy law, an inherited IRA is no longer considered a “retirement account” and is therefore accessible to creditors in bankruptcy. Learn how to protect your heirs.

Retrieved 8 of 8 Estate Planning blog posts

Stout Bowman regularly posts important and interesting information on our blog. Current topics include credit/debit/loans, estate planning, insurance, investing, Medicare, retirement, Social Security and taxes, as well as general information that we think you might find of interest.

Stout Bowman regularly posts important and interesting information on our blog. Current topics include credit/debit/loans, estate planning, insurance, investing, Medicare, retirement, Social Security and taxes, as well as general information that we think you might find of interest.  We have been publishing an email newsletter for our clients and friends since 2016. Links to all of the newsletters can be found on our newsletter page, with the most recent listed first. We try to keep our emails short, so there are typically only three articles in each one, most of which link to other articles in the financial and mainstream press.

We have been publishing an email newsletter for our clients and friends since 2016. Links to all of the newsletters can be found on our newsletter page, with the most recent listed first. We try to keep our emails short, so there are typically only three articles in each one, most of which link to other articles in the financial and mainstream press.  We also have a page on our site for the latest news about our company, notice of any upcoming events, and a market commentary to discuss what our advisors and other financial industry experts conclude about the previous investment performance and what we might expect the markets and the economy will do in the coming months.

We also have a page on our site for the latest news about our company, notice of any upcoming events, and a market commentary to discuss what our advisors and other financial industry experts conclude about the previous investment performance and what we might expect the markets and the economy will do in the coming months.